24+ Loan to value calculator

How to Calculate Your Loan-to-Value Ratio Calculating your vehicles LTV is pretty simple. Then enter that amount in the trade-in value.

Payoff Mortgage Early Or Invest The Complete Guide Pay Off Mortgage Early Mortgage Payoff Mortgage Tips

Loan to value calculator The loan to value LTV is the amount of your existing loan as a percentage of the value of your property.

. Whether youre wondering if you have enough equity to qualify for the best rates or youre concerned that youre too far upside-down to refinance under the Home. You can find this information on your monthly statement. You can do this by dividing your mortgage amount by the value of the property you want to buy then multiplying that by 100.

To find out how much to enter in the trade-in section of the calculator check your trade-in value and subtract the amount you owe on your car loan. Loan-to-value LTV is the ratio of mortgage to property value expressed as a percentage. The loan to value LTV ratio is 80 where the bank is providing a mortgage loan of 320000 while 80000 is your responsibility.

Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans. Our Loan to Value LTV Calculator is easy to use. The current average 10-year HELOC rate is 616 but within the last 52 weeks its gone as low as 255.

To calculate the amortized rate you must do the following. P V P M T i 1 1 1 i n PV is the loan amount. Enter your loan details including loan amount interest rate and loan term and then click.

Get Started In Your Future. Loan to value is the ratio of the amount of the mortgage lien divided by the appraisal value of a property. The Loan-to-Value LTV Calculator helps to calculate monthly loan payments for fixed-rate loans.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Loan to Value Ratio Formula. We can ignore PMT for simplicitys sake.

The resulting number is your loan to value ratio shown as a. Divide your interest rate by the number of payments you make per year. Loan To Value Mortgage Amount Property Value Loan to Value Ratio Definition The Loan to Value Ratio Calculator is a financial calculator that will instantly.

For loan calculations we can use the formula for the Present Value of an Ordinary Annuity. Loan to Value LTV Ratio 320000 400000 LTV Ratio. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

1 day agoTypically HELOC rates move in step with rate increases by the Fed. Total interest paid is calculated by subtracting the loan amount from the total amount paid. To calculate your loan to value simply enter your.

For example if youre buying a 100000 property with a 10000 10 deposit youll need a 90. Get more accurate data for financial models build and analyze comps quickly. Get Started In Your Future.

Enter your estimated home. If you put 20 down on a 200000 home that 40000 payment would mean the. For example the popular FHA loan program allows a down payment of just 35.

To see how the loan-to-value LTV formula works heres the basic formula and an example. Loan Amount Value of the Home After you have entered this. Get Offers From Top 7 Online Lenders.

Ad Need a Business Loan. Input 10 PV at 6 IY for 1 year N. I is the interest.

Ad Discover why PitchBook is the only tool you need for your next private company valuation. Pressing calculate will result in an FV of 1060. Figure out how much owe on your car loan.

Our Loan-to-Value LTV Ratio Calculator helps you estimate how much you owe on your mortgage compared to your homes current market value. Multiply that number by the remaining loan balance to find out. The maximum loan to value can also be thought of as a minimum down payment.

This calculation is accurate but not exact to the penny since in reality some actual payments may. It is possible to use the calculator to learn this concept. Find A One-Stop Option That Fits Your Investment Strategy.

This ratio or percentage of the amount of loan that would be forwarded against the appraised value of the property is known as the Loan to Value Ratio or LTV. You only have to enter two components to learn your loan to value. Typically a loan-to-value ratio should be 80 or less to avoid having to add PMI.

PMT is the monthly payment. Find A One-Stop Option That Fits Your Investment Strategy.

Pin By Farmington Mortgage A Divisio On Home Loan Infographics Process Infographic Home Loans Debt Relief Programs

Download Microsoft Excel Simple Loan Calculator Spreadsheet Xlsx Excel Basic Loan Amortization Schedule Template

How To Calculate Value At Risk Var In Excel Investing Standard Deviation Understanding

Monthly Amortization Schedule Excel Download This Mortgage Amortization Calculator Template A Amortization Schedule Mortgage Amortization Calculator Mortgage

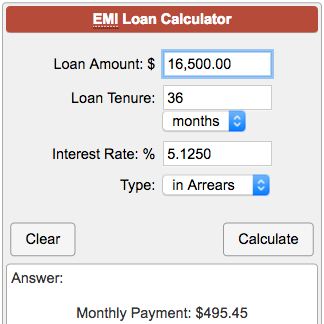

Emi Loan Calculator

Calculator Responsive Design Calculator Design Responsive Design Sale House

Home Loan Comparison Spreadsheet Amortization Schedule Mortgage Amortization Calculator Loan Calculator

Advanced Loan Calculator

Auto Loan Payment Calculator Spreadsheettemple Car Loans Car Loan Calculator Loan

Loan Calculator That Creates Date Accurate Payment Schedules

Loan Amortization Calculator

Installment Loan Payoff Calculator In 2022 Loan Calculator Mortgage Amortization Calculator Amortization Schedule

Loan Calculator Credit Karma

Download Future Value Calculator Excel Template Exceldatapro Excel Templates Financial Analysis Templates

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortizatio In 2022 Mortgage Amortization Calculator Amortization Chart Amortization Schedule

How To Calculate Loan Payments Using The Pmt Function In Excel Youtube

How Can You Efficiently Use Hdfc Personal Loan Calculator Personal Loans Amortization Schedule Loan Calculator