30+ How much can you lend mortgage

Lets say you can put down 25000 and are looking at a home with a price of 200000. Ad First Time Home Buyers.

30 Money Saving Challenges To Start Today Travel Savings Plan Saving Money Budget Money Saving Challenge

Fill in the entry fields.

. Common mortgage terms are 30-year or 15-year. For instance if you take on a mortgage loan that results in a total debt-to-income ratio of only 30 youre probably in good. The current average 10-year HELOC rate is 617 but within the last 52 weeks its gone as low as 255 and as high as 620.

This mortgage calculator will show how much you can afford. How much you can borrow for a mortgage. Interest ratethe percentage of the loan.

Enjoy A Stress-free Retirement And Save Using LendingTree. 392 rows Depending on your finances its good to take a shorter loan with payments you can afford. Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

Longer terms usually have higher rates but lower. Veterans Use This Powerful VA Loan Benefit For Your Next Home. This is what the lender charges you to lend you the money.

Check Your Eligibility for a Low Down Payment FHA Loan. Call us on 1800 20 30 35. Find out how much you could borrow.

You may need to use a specialist lender who could cap the amount of money. 1 day agoThis generally causes HELOC rates to move up. 1800 20 30 35.

If the 30-year fixed loan rate is at 4. Most home loans require a down payment of at least 3. Buying My First Home.

A shorter period such as 15 or 20 years typically includes a lower interest rate. Todays national 30-year mortgage rate trends On Tuesday September 13 2022 the current average rate for the benchmark 30-year fixed mortgage is 610 increasing 8. Lenders have a certain threshold they arent willing to cross.

Ad Take Advantage of Low Fixed Mortgage Rates Before Its Too Late. Youll pay a total of 18291055 in interest costs with a full 30-year fixed mortgage. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less.

Take the First Step Towards Your Dream Home See If You Qualify. With a capital and interest option you pay off the loan as well as the interest on it. Refinancing from a 30-year fixed-rate mortgage into a 15-year fixed loan can help you pay down your loan sooner and save lots of dollars otherwise spent on interest.

Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. Ad Calculate Your Payment with 0 Down. The amount of money you spend upfront to purchase a home.

Ad Take Advantage of Low Fixed Mortgage Rates Before Its Too Late. Most fixed-rate mortgages are for 15 20 or 30-year terms. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

So if you bring home 5000 per month your monthly mortgage payment should be no more than 1400. Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. This means you want to borrow 175000.

Compare Top Lenders Today. So if you can qualify for a 30-year fixed rate mortgage anywhere between 3 to 35 youre getting a solid dealCertain mortgages typically have higher rates like loans for. A mortgage loan term is the maximum length of time you have to repay the loan.

A 20 down payment is ideal to lower your monthly payment avoid. Based on how much you can borrow for your mortgage lets find out what your monthly repayments. Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today.

Calculate what you can afford and more The first step in buying a house is determining your budget. Capital and interest or interest only. For this reason our calculator uses your.

There are clear rules around how much money you can lend for a mortgage. With a general budget you want to have 50 of your income going. There are two different ways you can repay your mortgage.

The remaining 30 is personal interest and is generally not deductible. Ad See If You Qualify For Reverse Mortgage Loans.

Oaktree Wholesale Azoaktree Twitter

30 Years Of Impact Wesst Consulting Training Lending Incubation

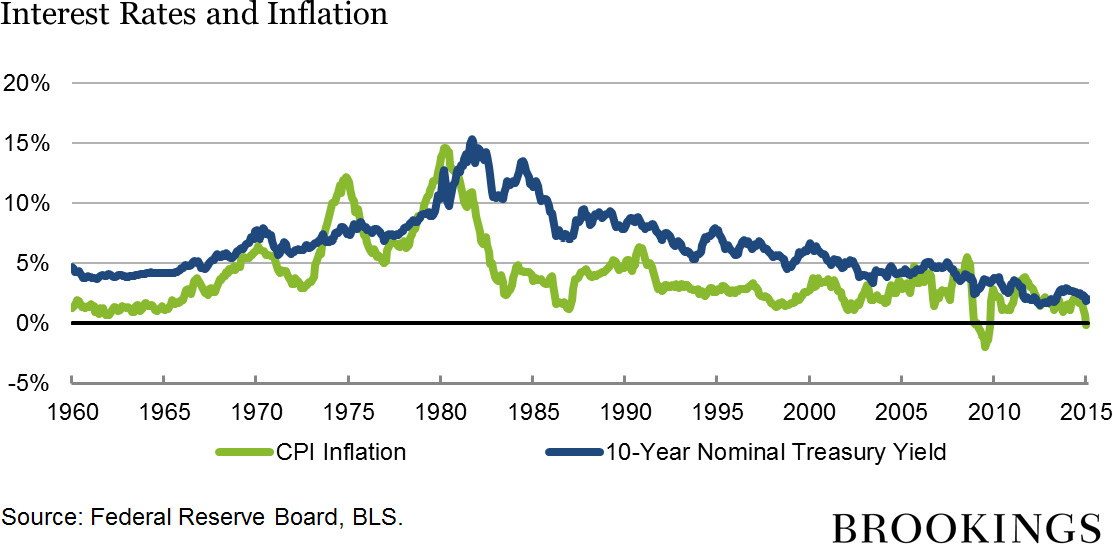

Why Are Interest Rates So Low

Is It Realistic For A Mortgage Loan Originator To Make Six Figures Quora

30 Money Saving Challenges To Start Today 52 Week Money Saving Challenge Money Saving Strategies Money Plan

19 Amazing Money Saving Challenges For You To Save More In 2019 The Best Of The Land Of Milk And Money Money Saving Challenge Savings Challenge Saving Mo

30 Space Saving Ideas And Smart Kitchen Storage Solutions Mutfak Depolama Kucuk Mutfak Mutfak Yeniden Modelleme

19 Amazing Money Saving Challenges For You To Save More In 2019 The Best Of The Land Of Milk And Money Money Saving Challenge Savings Challenge Saving Mo

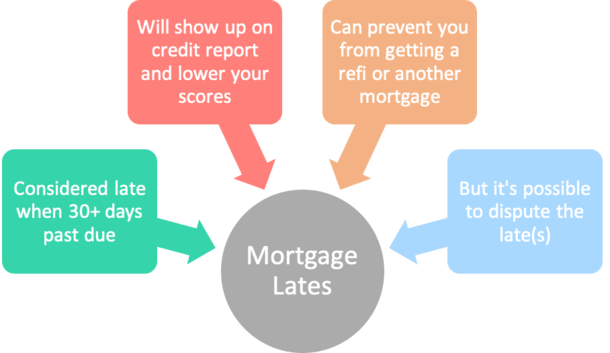

How To Quickly Remove Mortgage Lates From Your Credit Report

How To Save 500 A Month Challenge Money Saving Strategies Money Saving Plan Saving Money Budget

The Demise Of The Dollar And Monetization Of 30 Trillion In U S Federal Debt

Our Story Amerihome Mortgage Amerihome Mortgage

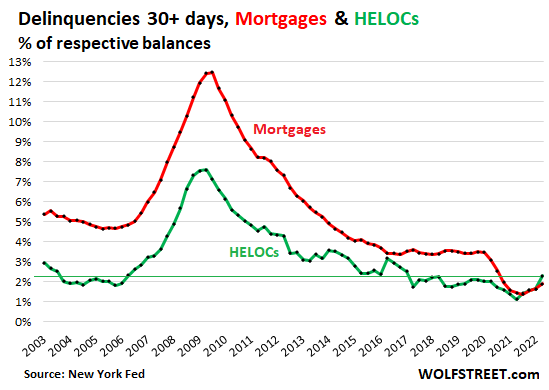

Mortgage Lender Woes Wolf Street

19 Amazing Money Saving Challenges For You To Save More In 2019 The Best Of The Land Of Milk And Money Money Saving Challenge Savings Challenge Saving Mo

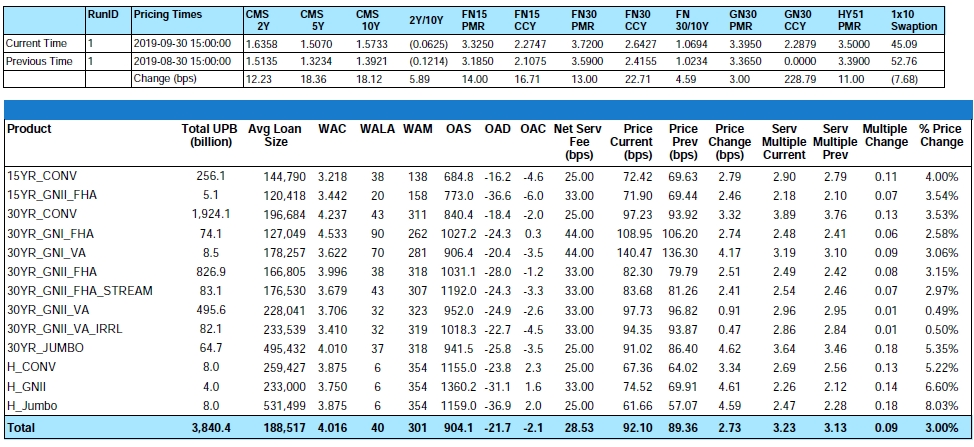

Residential Msr Market Update September 2019 Miac Analytics

Lendus Mortgage Rates 5 67 Review Details Origination Data

19 Amazing Money Saving Challenges For You To Save More In 2019 The Best Of The Land Of Milk And Money Money Saving Challenge Savings Challenge Saving Mo